Federal Income Tax Threshold 2025. Income in america is taxed by the federal government, most state governments and many local governments. For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

These rates apply to your taxable income. Income in america is taxed by the federal government, most state governments and many local governments.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Your taxable income is your income after various deductions, credits, and exemptions have been. See current federal tax brackets and rates based on your income and filing status.

Federal Withholding Tax Table Chart Tutor Suhu, For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying. The income tax brackets were bumped upward by 5.4%, lower than last year’s 7% increase but still more than typical.

Federal Budget 202324 Personal tax Pitcher Partners, The federal income tax system is. You probably have to file a tax return in 2025 if your 2025 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly.

2025 Tax Brackets The Best To Live A Great Life, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Chargeable income in excess of $500,000 up to $1.

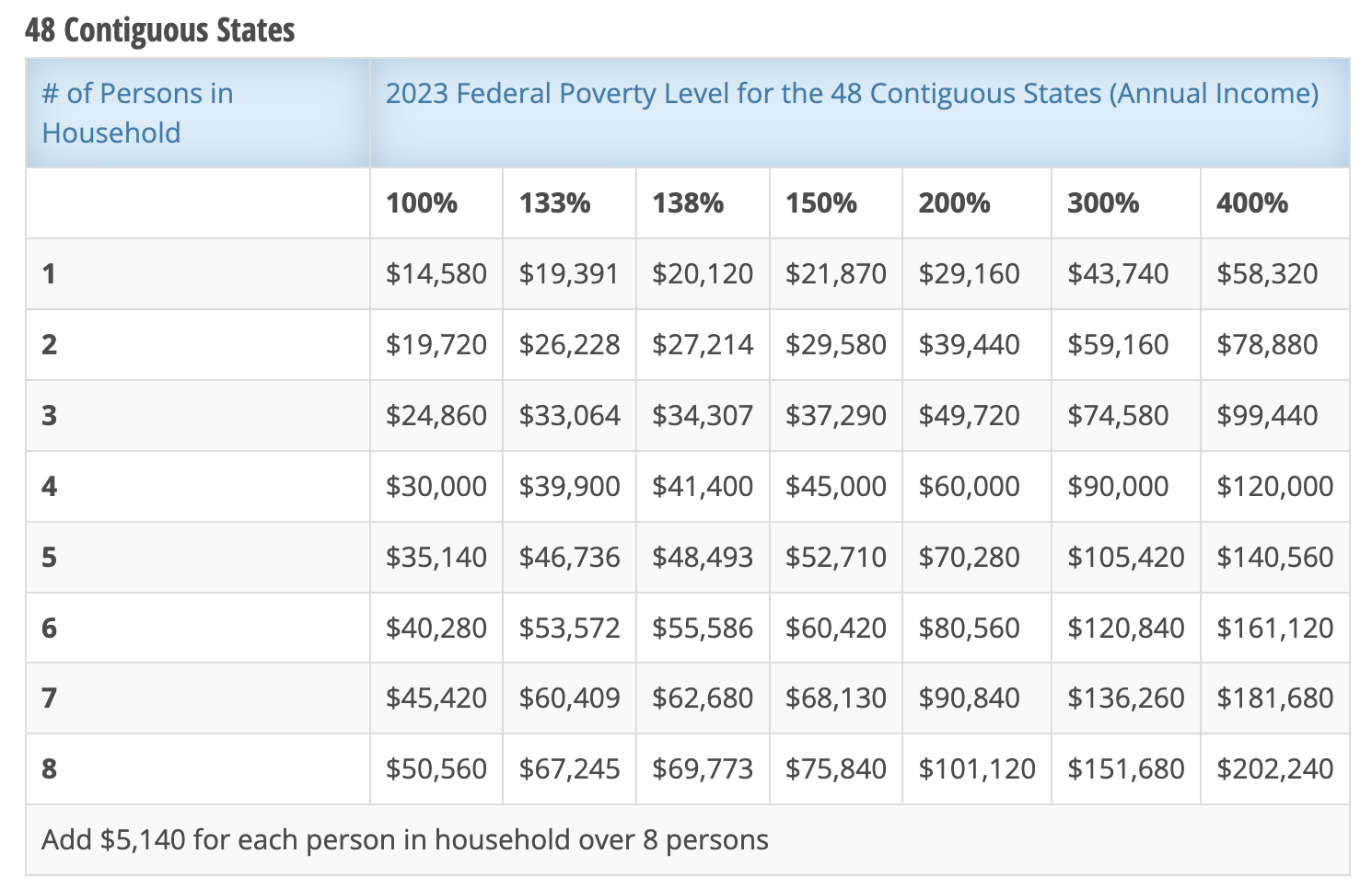

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, The new 2025 income tax brackets. Citizens and permanent residents who work in the united states need to file a.

T130241 Distribution of Federal Payroll and Taxes by Expanded, Page last reviewed or updated: Below, cnbc select breaks down the updated tax brackets for.

2025 Tax Filing Threshold Printable Forms Free Online, The income thresholds for each bracket,. Page last reviewed or updated:

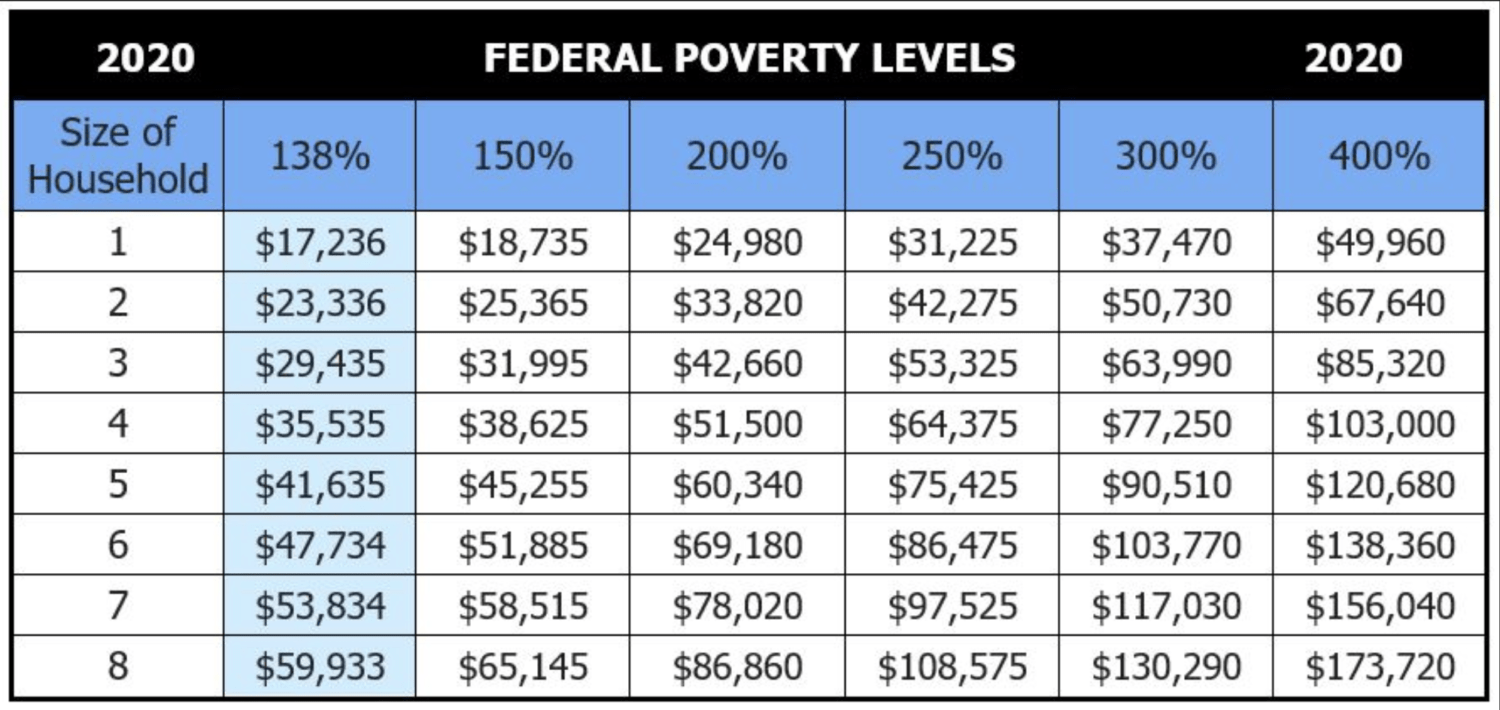

Maximizing Premium Tax Credits for SelfEmployed Individuals, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 2025 federal income tax rates.

Federal Tax Return Calculator 2025 Latest News Update, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. You probably have to file a tax return in 2025 if your 2025 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly.

2025 Federal Poverty Level Chart Comrade Financial Group, Page last reviewed or updated: For tax year 2025, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

Silverstone 2025 Tickets Price. Book your standing or grandstand seats at p1 travel for the british grand prix ! Resale[...]

Columbus Chamber Clambake 2025. 🍽️ for nearly a century, the columbus chamber of commerce has brought together community and business[...]

13 Levels Of Fear 2025 Dates. Find fear tour dates for 2025 & 2025 , concert details and compare prices.[...]