What Is Boi Reporting 2025 Schedule. How do i get a fincen id?. Fincen began accepting reports on january 1, 2025.

Understanding the deadlines for beneficial ownership information (boi) reporting is crucial for businesses to maintain compliance and avoid potential penalties. Washington—the financial crimes enforcement network (fincen) issued a final rule today that extends the deadline for certain reporting companies to file their initial.

Step 2 Cs Reporting Schedule 2025 Form Jolee Madelon, At ¶ 30) and earning interest income of “at least $18,503.19” (id.

Understanding the 2025 BOI Reporting Requirements — AJB Law, Department from enforcing the boi reporting rules, meaning the agency can't impose penalties while the court.

BOI Filing How to File BOI Report Online for 2025, On december 3, 2025, in texas top cop shop, inc.

Demystifying new BOI Reporting for 2025 A NoSweat Guide for Business, Reporting companies formed before 2025 must file an initial boi report no later than january 1, 2025.

BOI Reporting New for 2025 The Boom Post, Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

2025 BOI Reporting Navigating Requirements for Your Business YouTube, Beginning january 1, 2025, entities must comply with the corporate transparency act ’s beneficial ownership reporting requirements.

BOI Reporting Requirements for 2025, Schedule a meeting with us to talk through your reporting requirements for 2025.

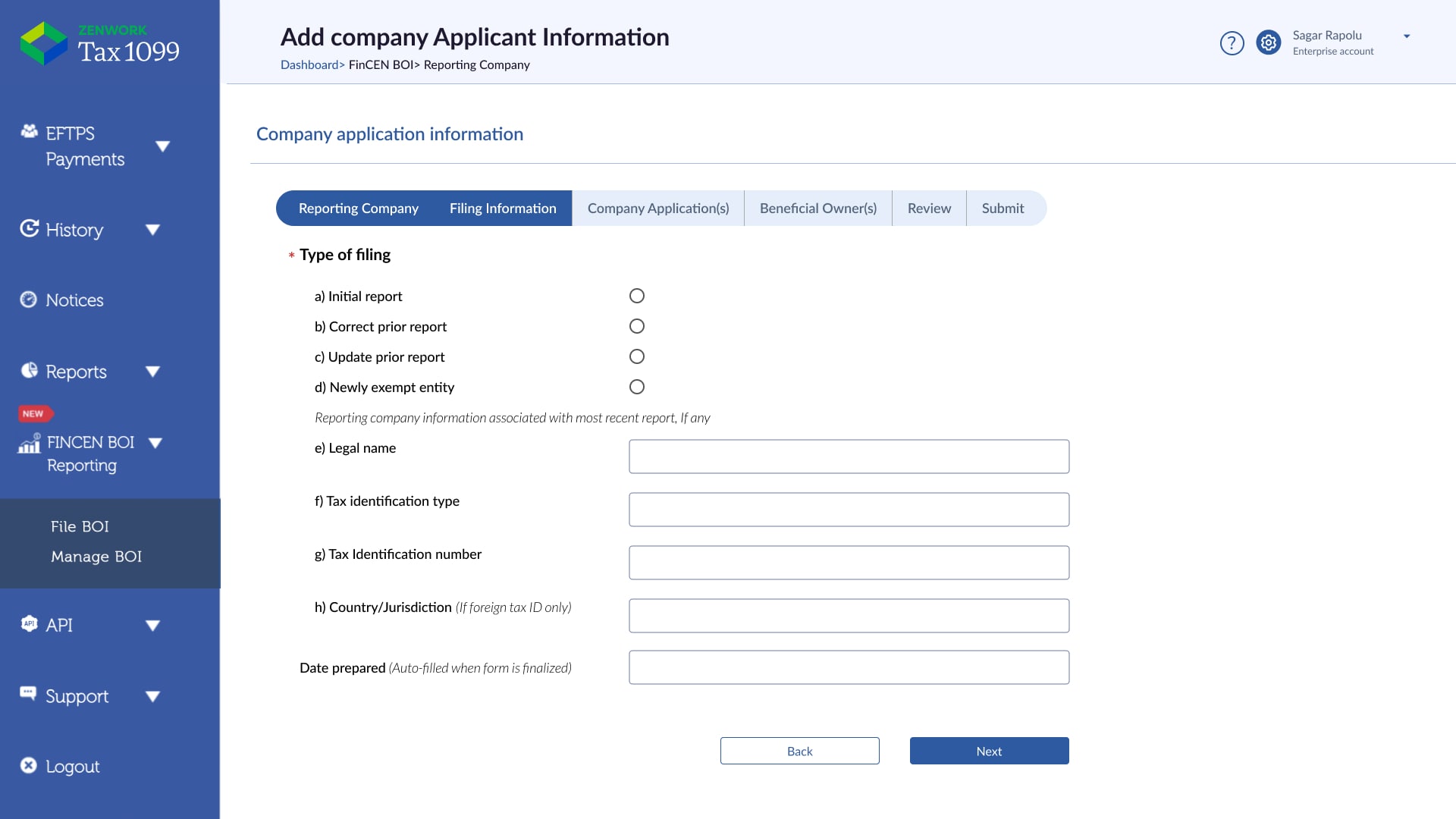

FinCEN BOI Reporting Requirements in 2025 Tax1099 Blog, The corporate transparency act (cta) of 2025 requires entities to report beneficial ownership information (boi) to the u.s.

All You Need To Know About Beneficial Ownership Information Reporting, The online beneficial ownership information reporting tool streamlines the submission process.

File BOI Reporting Online How to file BOI Report 2025 Tax1099, Companies that existed prior to 2025 must report by jan.